LIBOR Transition

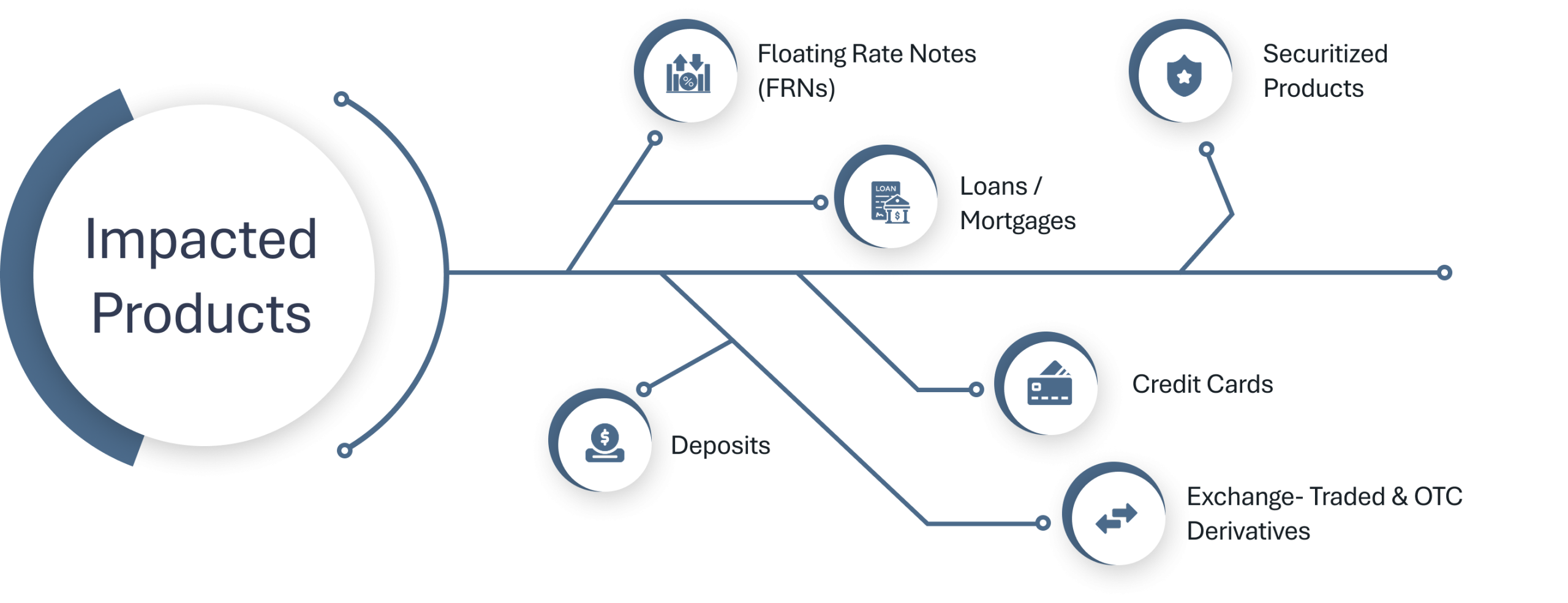

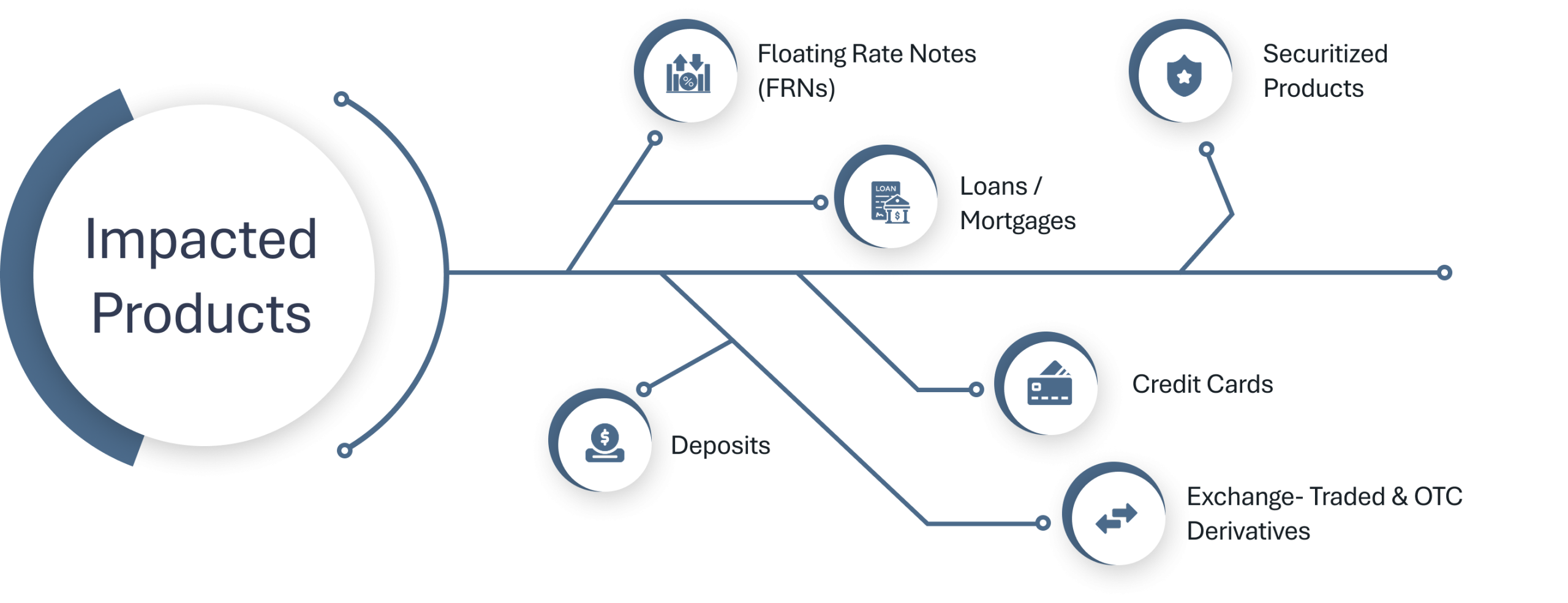

A far-reaching ecosystem challenge that impacts nearly every aspect of large financial institutions across people, processes, and technology:

LIBOR and other Inter-bank Offered Rates (IBORs) came into widespread use in the 1970s and are meant to reflect the costs of unsecured inter-bank borrowing. Over the last 50 years IBORs have become intertwined in banking products and underpin >$350 Trillion of financial products, touching everything from contracts/legal, technology/systems, communications, models, risk, audit, data, finance, compliance, accounting/tax, and more. Following the financial crisis, manipulation and increasingly illiquid markets underlying the LIBOR benchmark rate led regulators to launch a global initiative to transition away from LIBOR. Through the FSB, the FRB, CFTC, BOE, and ECB began compelling market participants to begin cessation with a target completion by YE 2021.

A far-reaching ecosystem challenge that impacts nearly every aspect of large financial institutions across people, processes, and technology:

LIBOR and other Inter-bank Offered Rates (IBORs) came into widespread use in the 1970s and are meant to reflect the costs of unsecured inter-bank borrowing. Over the last 50 years IBORs have become intertwined in banking products and underpin >$350 Trillion of financial products, touching everything from contracts/legal, technology/systems, communications, models, risk, audit, data, finance, compliance, accounting/tax, and more. Following the financial crisis, manipulation and increasingly illiquid markets underlying the LIBOR benchmark rate led regulators to launch a global initiative to transition away from LIBOR. Through the FSB, the FRB, CFTC, BOE, and ECB began compelling market participants to begin cessation with a target completion by YE 2021.

Our Delivery

Eclipse mobilized teams to handle various cessation activities for a global banking organization:

- Established program governance for the LIBOR Transition Office and federated teams across business units, including top-down program sponsorship.

- Established central PMO communication and reporting/monitoring cadences.

- Conduct initial impact assessments and transition planning exercises.

- Internal stakeholder identification and engagement.

- Established working groups as needed for information sharing, decision making, and execution planning (e.g. product aligned groups as well as horizontal enterprise functions).

- Developed inventories of products and contracts linked to IBORs and quantified exposures.

- Segmented exposures for legacy and new business with consideration for materiality and roll off.

- Assessed fallback provisions and triggering by product and contract type.

- Determine repapering requirements / contract amendments as well as tactical vs. strategic efforts (e.g. contract digitization, machine learning for smart tagging, etc.)

- Evaluated operational exposures across people, processes, and technology.

- Designed a holistic client communication plan.

- Assessed needs for system/infrastructure and process changes.

- Built detailed program execution plans.

Our Value